Digital Economy Tax Platform for the Journey from Tax Policy to Revenue

Ascoria is a comprehensive platform that unlocks and mobilizes revenue created by activity in the digital economy.

Built to integrate with existing tax systems and scale with your needs.

Empowering Governments. Shaping the Digital Future.

For Governments

We provide comprehensive end-to-end digital services tax management, featuring:

- Robust registration and returns management system for digital service providers

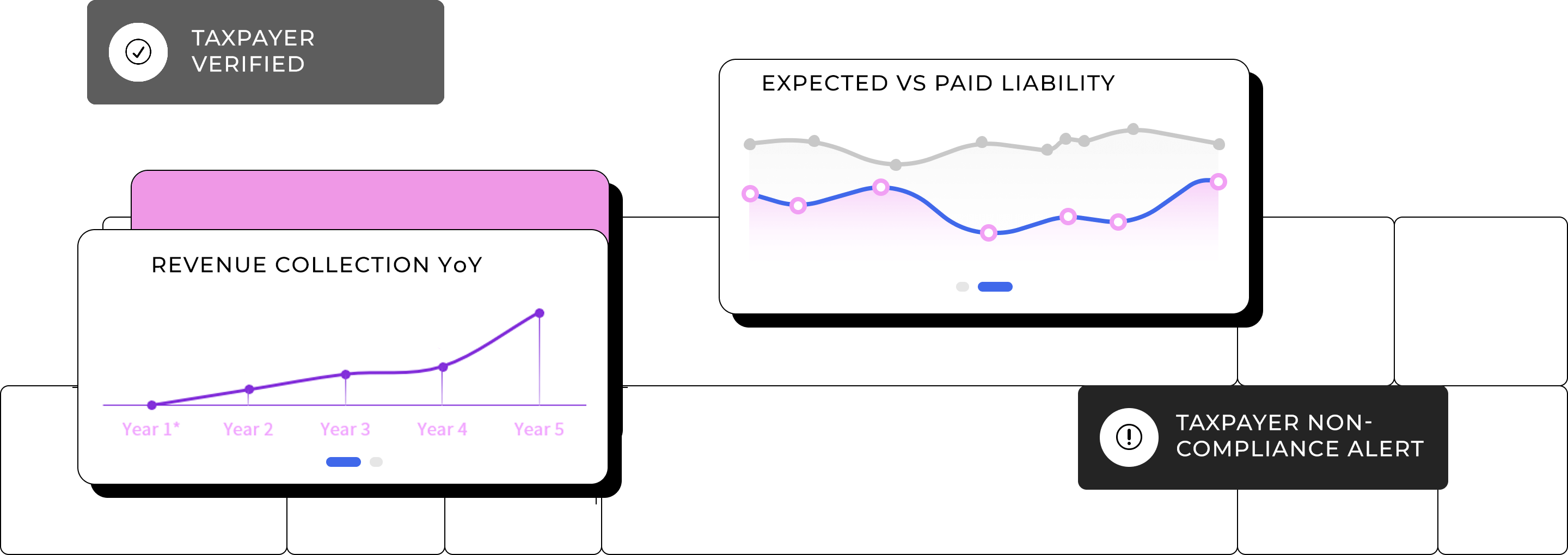

- Advanced analytics for tracking digital revenue streams

- Secure taxpayer data protection with enterprise-grade security

- Seamless integration with existing tax infrastructure

- Clear processes and guidance for digital service providers

For Taxpayers

We streamline multinational digital services tax compliance through:

- Standardized registration processes across jurisdictions

- Clear guidance on revenue calculation and reporting

- Secure payment systems supporting 130+ currencies

- Real-time compliance monitoring and alerts

- Integration with major accounting systems

Use the power of Artificial Intelligence for your revenue service

Discover the benefits of artificial intelligence with Ascoria. By implementing automated data strategies, you can streamline your processes, engage taxpayers with personalised content, and drive compliance effortlessly.

Connect to your taxpayer data.

Using the latest developments in machine learning Ascoria can bring your taxpayer data to life like never before.

Grow taxation revenues with compliance as a service

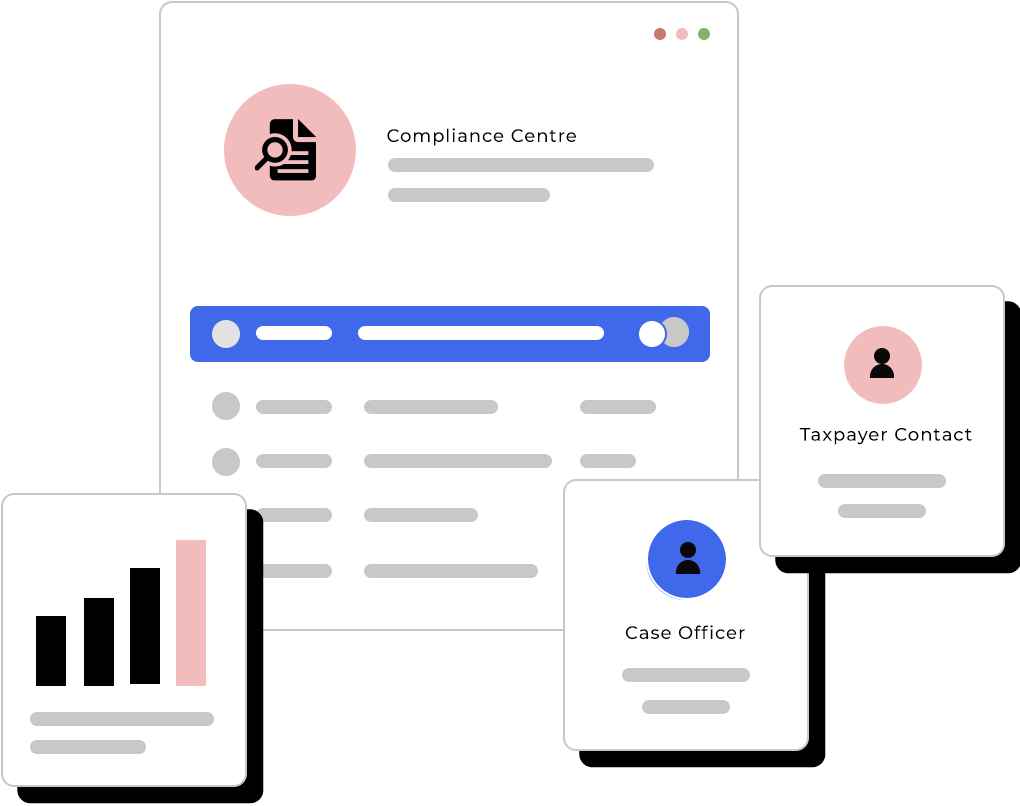

Target compliance activities

Provide tailored processes and configurable software

Help build an effective compliance unit for your country.

Connect existing infrastructure to boost overall taxation revenues.

The Ascoria platform is built to run on any system. Created with integration in mind we can connect with any data source to give you the greatest insight in to taxpayer activities.